Equity crowdfunding was conceived as a way for early-stage ventures to raise capital in their home markets. Few early-stage companies can afford the time and cost involved in preparing a prospectus or product disclosure statement (PDS) ordinarily required for a public offer, but crowdfunding regulations provide a way of making a public offer, subject to annual fundraising caps noted in the table below, and other restrictions.

This blog was prepared by Nathan Rose & Simon Papa. The information in this blog is correct as at June 2016.

See Cygnus Law’s Equity Crowdfunding Guide for detailed information on legal factors you may need to consider when getting ready for, and running, an equity crowdfunding campaign using a licensed platform in New Zealand.

The caps only apply to offers to retail investors and without a prospectus/PDS. More lately, the platforms that facilitate these raises under crowdfunding regulation have been extending their services to include offers under securities law exemptions (e.g. to sophisticated/accredited investors), parallel offers in multiple countries, and prospectus offers. “Equity crowdfunding” appears to have expanded beyond its original definition.

Brewdog in the UK offered a prospectus when it raised funds through Crowdcube and on their own site. This prospectus allowed Brewdog to escape the EUR5 million limit that non-prospectus equity crowdfunding offers must abide by. Syndicate Room has also embraced this broader definition, when it was approved as a member of the London Stock Exchange, and acted as an intermediary for the initial public offering of HealthCare Royalty Trust.

Equitise in New Zealand/Australia (but operating under a NZ licence) has been innovative. An Australian company undertaking an IPO and ASX listing in Australia, Dongfang Modern, also offered the shares through Equitise’s platform to NZ investors. An offer for SKINS in Europe through Seedrs was also made through Equitise, to NZ investors as a “standard” crowdfunded offer and to sophisticated investors in Australia (which has yet to permit retail equity crowdfunding).

What these examples highlight is the extent to which regulations facilitating internet-based equity offers have introduced wider change, which has leveraged off the platform technology developed and the drive to innovate.

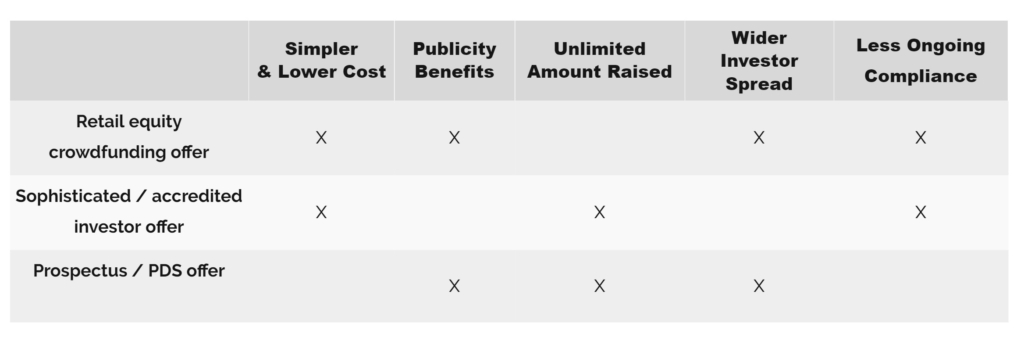

With these additional options on the table, the various pluses and minuses of different uses of equity crowdfunding regulation need to be properly considered by companies seeking capital. The table below gives a summary of factors to consider in relation to common capital raising options.

Option 1. Retail equity crowdfunding offer

Using the equity crowdfunding regulations to make an offer of shares to the public is the simplest approach, and the one which will still suit many early-stage ventures. It provides the publicity benefits that are one of the hallmarks of crowdfunding, while being far less burdensome to prepare than a prospectus offer and potentially imposing fewer on-going compliance obligations.

So long as your company isn’t overly concerned about privacy and doesn’t need to raise more than the cap mandated by crowdfunding regulation, retail equity crowdfunding is a potential option.

Option 2. Sophisticated / accredited investor offer

As this avenue keeps the offer more private, the business plan, financials and valuation of your company will not be exposed to the public. For some businesses, the disadvantage of revealing this commercially sensitive information to one and all may be too important to trade off against the publicity advantages.

This option also allows an uncapped raise, but will cut down the audience that can be marketed to. If you have confidence about the investors you have lined up, using an equity crowdfunding platform to facilitate these raises may be for you.

Option 3. Prospectus/PDS offer

A prospectus or PDS offer gives you the ability to raise as much as you like and to market to anyone, including retail investors. It isn’t crowdfunding regulation, but crowdfunding portals can still use it.

They are, however, very time-intensive and costly to prepare – they follow a prescribed format and will likely require a lot of hours from professional service firms. In some countries such offers can only be made by a public company. Also consider the additional reporting requirements following the raise – depending on the country, you may need to produce annually audited financial accounts or use of proceeds schedules. There may be other on-going compliance obligations as well, including in relation to disclosure and record-keeping.

Reckon on tens-of-thousands of dollars of expense, just to get to the start line. If you can cover this cost, by all means, consider the prospectus/PDS route to enable the greatest amount of flexibility in capital raise amount and investor base to market to.

—

Deciding on how and whether to raise capital is a big decision. Different platforms specialise in each of these options, so seek out their opinions about what you want to do and ask about their experience. And most importantly, surround yourself with good advice. On that topic, securities law is complex and this article is provided as a broad overview, is not legal advice and should not be acted or relied upon without seeking legal and other expert advice.