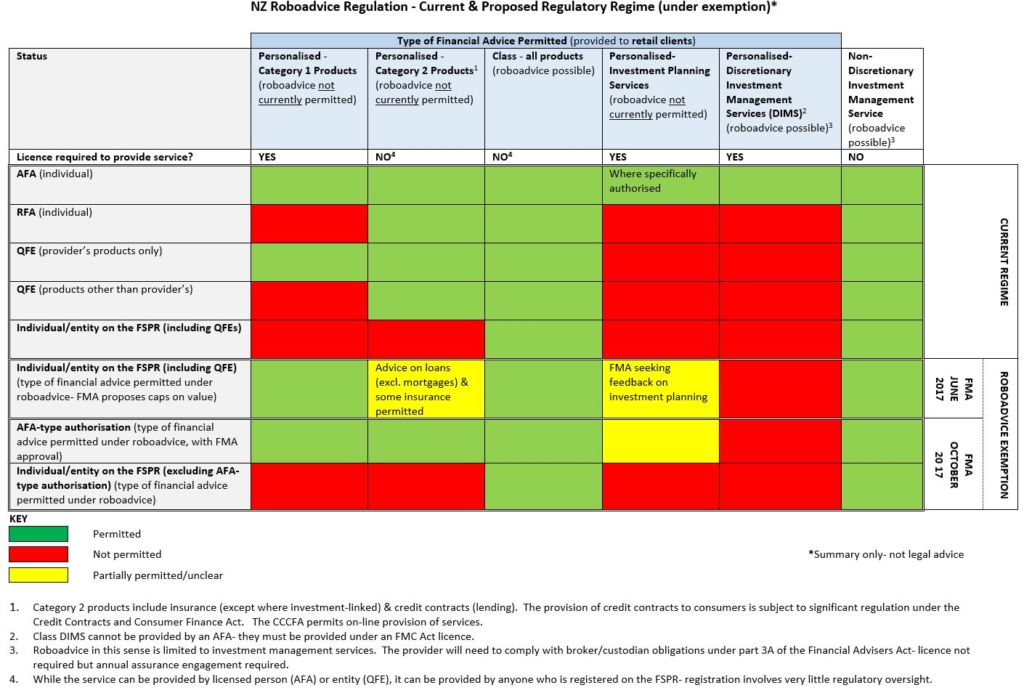

The Financial Markets Authority announced on 18 October 2017 that it will allow full robo-advice to be provided in New Zealand. That is, it will be possible to deliver personalised financial advice online using algorithms. FMA is aiming to accept applications for authorisation in early 2018. FMA is permitting robo-advice under its power to grant exemptions to existing financial advice law, which currently requires any “personalised” financial advice to be provided by a human. The exemption is being adopted as a stop-gap measure pending a proposed new law, expected to be in place in 2019, that will authorise robo-advice and will require all robo-advice providers (and all other financial advice firms) to hold a licence. I summarise key features of the exemption below. The following landscape shows at a high-level the current (complicated) regulatory regime for financial advice services, FMA’s June 2017 robo-advice exemption proposal and the exemption to be adopted.

Regulatory Landscape

Background

FMA proposed a roboadvice exemption in June 2017 and sought submissions. I commented on the exemption, highlighting that it appeared to have many features of a “regulatory sandbox, and outlining Cygnus Law’s submissions on the proposal. FMA received 49 submissions on the proposed exemption and has responded to some of the concerns raised in those submissions.

Key Features of the Roboadvice Exemption

The exemption to be adopted includes the following key features:

Allowing personalised roboadvice: Under current law “personalised” financial advice (advice that takes a person’s individual situation into account) must be provided by a human. The exemption will permit personalised roboadvice to be provided. That is, it will be possible to deliver personalised financial advice online using algorithms. This is already permitted in many countries and has led to significant innovations in advice delivery.

All products permitted & no value caps: FMA had proposed that certain financial products would be excluded from the exemption, for example life insurance and mortgages. FMA had also proposed caps on the value of financial products that could be advised on. Those limits and caps won’t be included in the exemption. FMA’s announcement is silent on financial planning services- FMA had queried whether they should be covered by the exemption. Given the absence of limits and caps my assumption is that financial planning services will be permitted to be provided via roboadvice – this will be confirmed when the draft exemption is available in November 2017.

Authorisation required: FMA had proposed a very “light touch” approach to regulation of roboadvice under the exemption, which would have allowed anyone to provide roboadvice provided they met “good character” requirements. However, the exemption will require applicants to follow a similar process for authorisation as that for “authorised financial advisers” (AFAs). AFAs are individuals who advise on investments. So roboadvice providers will need to submit an application for authorisation to FMA, showing that key individuals are of good character and that the provider has the capability and competence to provide roboadvice. The FMA has declined to require applicants to meet the more exacting licensing standards that apply to “qualifying financial entities” (something Cygnus Law and other submitters had proposed). FMA will consult on the application process and exemption notice in November 2017. FMA rejected submissions that the standards under the proposed licensing regime be applied under the exemption, on the basis that FMA cannot bring forward the relevant requirements and that many are still in development. It’s possible that the exemption will provide for transition to the licence regime under the proposed law.

AFA standards to apply: FMA had proposed that many elements of the Code of Professional Conduct that applies to AFAs would not apply to a roboadvice service. FMA appears to have stepped back from that and will require that roboadvice “be delivered in a manner that is consistent with the principles of the Code of Professional Conduct”.

FMA’s roboadvice exemption is a very positive development and will support the development of new and innovative financial advice services that benefit consumers. The exemption will also bring New Zealand’s financial advice law into line with Australia and other countries with respect to roboadvice.