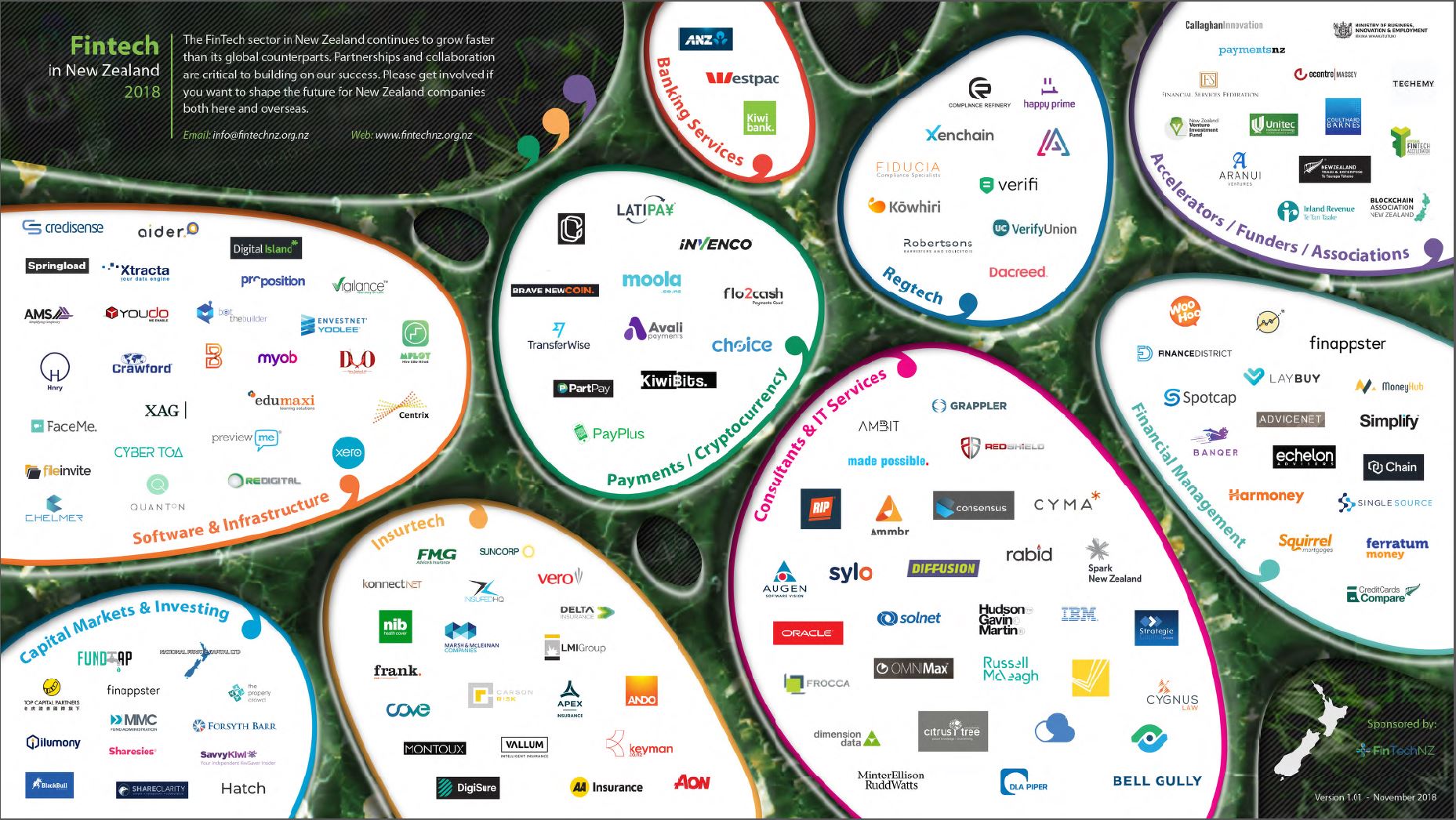

FinTechNZ recently published the first detailed New Zealand FinTech ecosystem map–

The map highlights the high level of FinTech innovation in New Zealand. The map covers FinTechNZ members. This type of map is a valuable way to help to link current and future sector participants and to highlight New Zealand as a tech success story to the world.

FinTech is the combination of financial services with technology to produce new types of financial services and new ways of delivering them. FinTech is not new, for example New Zealanders were early adopters of payment technology through the EFTPOS system. But the scale, pace and nature of FinTech innovation has increased greatly in the last ten years. That has been driven by a number of factors, including access to cheap & powerful computer technology, the internet, smartphones and the availability of investment capital. In China (and other countries that lack traditional financial services infrastructure) FinTech has become the main mode for delivering retail financial services, through giants such as Alipay and WeChat Pay.

The pace of change is now accelerating in New Zealand. There are exciting FinTech businesses delivering innovative and accessible financial services to New Zealand consumers and businesses. Significant innovation is occurring outside of the consumer-focused sector, with large investments being made in “back-end” systems that support existing businesses. “Regtech” is an example, being technology that supports businesses to comply with ever-expanding regulatory obligations.

A trend overseas is the development of “neobanks”. Neobanks are online only and provide some key banking services. They are still at an early stage of development and often don’t have banking licences themselves. However neobanks present the possibility of significant challenge, in time, to the dominance of traditional banks in core areas such as cheque accounts, credit cards and payments. There are no neobanks in New Zealand- Volt became the first Australian neobank to obtain a licence in January 2019.

FinTech is accelerating in New Zealand despite the fact that New Zealand innovators don’t have access to the same institutional support & capital available in some comparable countries. This highlights the very real capability of New Zealand innovators and the high degree of entrepreneurial activity. However, lack of investment capital in many sectors, beyond that required for fairly early stage growth, is an on-going issue- NZ lacks a significant venture capital base.

A key question is whether regulation is keeping up with & supporting FinTech development (something I’ve commented on before- Regulatory Innovation in FinTech, Law reforms threaten New Zealand financial service exports & NZ FinTech in 2017- make or break?) This can be a difficult area, with support for innovation needing to be balanced against consumer protection. Positive change is happening in New Zealand including the decision by the FMA last year to approve the provision of “roboadvice” (personalised financial advice delivered online) subject to conditions. The government is currently encouraging an “open banking” initiative that aims to open up New Zealand’s payments infrastructure to new players.